In regards to securing your long term and making certain relief, insurance coverage methods Enjoy A necessary part. No matter if you’re shielding your property, wellness, car, or organization, owning the best insurance solution could make all the difference. But Enable’s be trustworthy—navigating the earth of insurance coverage can feel just like a maze. With lots of selections, where do you even get started? Don’t fear; we’ve obtained you protected! In this post, we’ll break down the ins and outs of insurance plan options, rendering it simple in your case to understand and opt for what performs very best for your requirements.

So, what exactly is undoubtedly an insurance coverage Remedy? At its Main, it’s a method or a package deal of merchandise that provides financial security in opposition to several different dangers. Coverage answers may vary based on the sort of protection they offer. Such as, a home insurance Answer might cover damages on your property, while a existence insurance coverage Option ensures your family and friends are fiscally supported If your unexpected comes about. It’s like owning a security Web that catches you when life throws you off balance.

Facts About Insurance Solution Uncovered

Insurance coverage alternatives can be found in quite a few shapes and sizes, and one particular measurement unquestionably doesn’t healthy all. The best Remedy for you are going to rely upon a couple of variables, like what You are looking to safeguard, your funds, plus your exceptional conditions. Enable’s dive deeper into why choosing the right insurance policy solution matters. Envision looking to build a home with out a stable Basis—it’s certain to crumble, ideal? That’s why deciding on the correct insurance coverage is like laying down that stable Basis. It secures every thing else that comes soon after.

Insurance coverage alternatives can be found in quite a few shapes and sizes, and one particular measurement unquestionably doesn’t healthy all. The best Remedy for you are going to rely upon a couple of variables, like what You are looking to safeguard, your funds, plus your exceptional conditions. Enable’s dive deeper into why choosing the right insurance policy solution matters. Envision looking to build a home with out a stable Basis—it’s certain to crumble, ideal? That’s why deciding on the correct insurance coverage is like laying down that stable Basis. It secures every thing else that comes soon after.Now, Permit’s take a look at the differing types of insurance coverage methods you may perhaps want. Initially off, Now we have daily life insurance policies. This is often One of the more typical types of insurance. Existence insurance coverage provides a money cushion for Your loved ones just in case you’re no more close to to deal with them. It’s not just about the money part, although. It’s concerning the satisfaction figuring out that, even though you’re long gone, All your family members won’t have to bother with creating finishes meet.

Then there’s wellness insurance coverage, which, in these days’s planet, is much more significant than ever before. Consider wellbeing coverage as a security net for in the event the unexpected comes about—regardless of whether that’s an crisis room take a look at, operation, or prescription drugs. With the correct health and fitness coverage Alternative, you won’t should Imagine 2 times about whether or not you are able to manage treatment method. It’s like possessing a support technique all set to catch you when issues go Erroneous.

Auto insurance plan is another key participant on earth of insurance answers. Picture you’re driving your vehicle down the road and—growth—there’s an accident. What transpires then? Very well, Should you have a good auto insurance Answer, you may relaxation easy being aware of your costs are coated. Irrespective of whether it’s repairs, medical expenditures, or harm to another person’s assets, having the ideal car coverage assures you won’t facial area economical hardship when issues go wrong on the street.

Don’t forget about homeowners’ insurance coverage, possibly. Your home might be certainly one of the most significant investments you’ll at any time make, so it only is smart to safeguard it. Homeowners’ insurance coverage can protect everything from hearth and flood damage to theft and vandalism. It’s like putting Continue reading a protection program on your home, except this a single ensures you gained’t reduce every little thing if catastrophe strikes.

But coverage answers aren’t nearly preserving physical items—Additionally they cover your cash flow. Disability insurance coverage, one example is, will help swap a portion of your income for those who develop into unable to operate resulting from illness or harm. Without the need of it, you might find yourself in a troublesome spot fiscally, particularly when you rely upon your cash flow to help you and Your loved ones.

Some Ideas on Insurance Solution You Should Know

Another type of insurance policies Resolution worthy of mentioning is organization insurance policy. No matter if you’re jogging a little side hustle or managing a considerable corporation, business insurance coverage is essential. This can consist of all the things from legal responsibility coverage to residence insurance, making Go here certain that your company is shielded from a variety of probable pitfalls. Think about it like putting up a protective shield all around your small business so that you can concentrate on progress devoid of continually stressing with regards to the ‘what-ifs.’Now that we’ve lined the most crucial forms of insurance policies solutions, Allow’s take a look at why it’s vital To guage your options cautiously. The earth of insurance coverage can be a very little overwhelming, with countless suppliers presenting distinct offers. How Did you know which a single is the correct match to suit your needs? The crucial element is to compare insurance policies. This implies taking a look at coverage restrictions, deductibles, premiums, as well as popularity in the insurance service provider. You wouldn’t buy a auto without having examining the specs, ideal? A similar goes for insurance.

One more important point is comprehending your requirements. Take a minute to consider your lifetime situation. Do you have Young children who count on you? Do you individual residence? Have you been self-employed? These elements all play a role in figuring out the sort of coverage Remedy that’s ideal for you. By way of example, in the event you’re a parent with youthful youngsters, you may want to prioritize life coverage and health insurance plan around other kinds of protection. If you’re a business proprietor, enterprise insurance policies may be at the top Continue reading of your respective listing.

Insurance Solution Things To Know Before You Get This

There’s also the issue of Price. Though it might be tempting to Opt for The most cost effective choice available, do not forget that you obtain Everything you purchase. A cheap insurance solution won't deliver the protection you would like whenever you need to have it most. In place of just concentrating on the worth tag, take into account the worth the plan features. A slightly larger top quality could possibly be worthwhile if this means improved security.

You could be wanting to know, “Why not only go with out insurance plan?” Very well, that’s like driving an auto without having insurance coverage—it’s risky. Without insurance, you may be remaining having to pay out-of-pocket for unforeseen occasions, and those fees can increase up immediately. Certain, you might help save a little income upfront, nevertheless the opportunity monetary burden could much outweigh the price savings.

But in this article’s the point: Insurance coverage answers aren’t pretty much possibility management. They’re also about providing you with peace of mind. Any time you know you’re coated, you can slumber simpler during the night, understanding that if anything goes wrong, you received’t really need to confront it on your own. Which satisfaction is priceless.

As we wrap up, it’s crucial that you take into account that insurance policies solutions are there to assist you to navigate the uncertainties of daily life. Whether or not it’s a unexpected illness, a mishap, or damage to your house, acquiring the appropriate protection usually means you won’t be remaining in the lurch. So take the time to evaluate your preferences, Examine choices, and select the answer that gives you the safety and comfort you should have.

In conclusion, while the insurance policies environment might seem intricate in the beginning glance, it doesn’t must be. By comprehending the differing types of insurance policy remedies and why they issue, you can make knowledgeable decisions regarding your monetary potential. Recall, the right insurance Alternative is undoubtedly an financial investment inside your protection and nicely-staying, supporting you face existence’s worries with assurance. Don’t hold out until it’s way too late—start out exploring your coverage options today and provides yourself the satisfaction that includes knowing you’re protected.

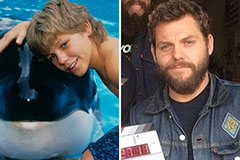

Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Michael Fishman Then & Now!

Michael Fishman Then & Now! Seth Green Then & Now!

Seth Green Then & Now! Gia Lopez Then & Now!

Gia Lopez Then & Now! Ricky Schroder Then & Now!

Ricky Schroder Then & Now!